Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

On Tuesday, the Dow Jones Industrial Average experienced a decline as investors considered the prospects of Congress passing a tentative deal to raise the U.S. debt ceiling. The index closed down 50.56 points or 0.15% at 33,042.78. Meanwhile, the S&P 500 managed to eke out a minimal gain of 0.002%, closing at 4,205.52, and the Nasdaq Composite rose by 0.32% to finish at 13,017.43, albeit after paring back earlier gains.

Over the weekend, President Joe Biden and House Majority Leader Kevin McCarthy reached an agreement to raise the debt ceiling, aiming to avoid a default. The proposed bill will require support from both Republicans and Democrats to pass, with Congress scheduled to vote on it as early as Wednesday. Despite this progress, there are still hurdles to overcome in the House, as opposition within the GOP has been growing.

Investors also expressed concerns about the possibility of an interest rate hike by the Federal Reserve. According to the CME Group’s FedWatch tool, traders are currently pricing in a 68.8% chance of a rate increase next month. Richmond Fed President Tom Barkin maintained his rate forecast, stating that he hasn’t changed his position and that his forecast is among the higher ones within the central bank. The market is closely watching the Fed’s actions and how incoming inflation data will influence its decisions.

The Nasdaq received a boost from Nvidia, an artificial intelligence-related stock, which saw a nearly 3% rally. The stock reached a market capitalization of $1 trillion during Tuesday’s session, joining the elite group of companies that have achieved this milestone, following its strong earnings report from the previous week.

Data by Bloomberg

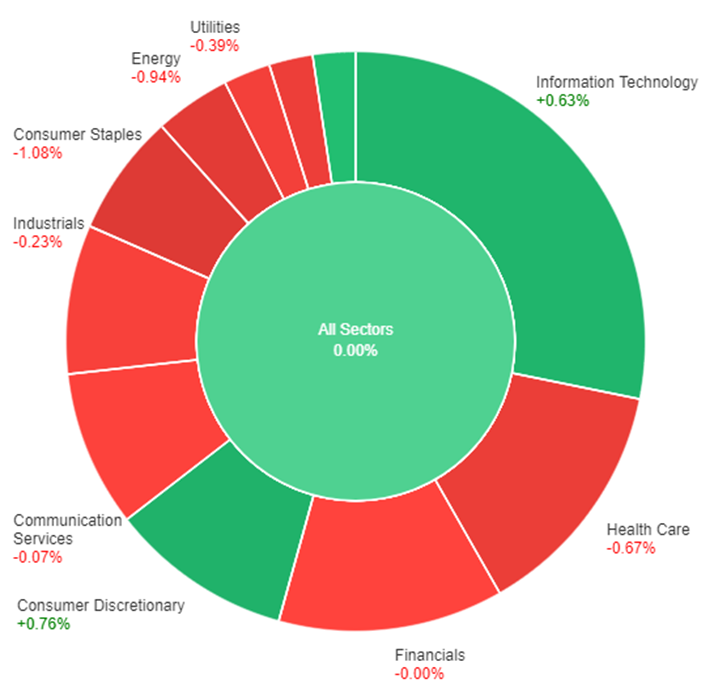

On Tuesday, the overall market performance was neutral, with all sectors collectively showing no change (+0.00%). Among the sectors that experienced gains, Consumer Discretionary had the highest increase of 0.76%, followed by Information Technology at 0.63%. Real Estate showed a modest increase of 0.27%. On the other hand, several sectors recorded losses.

Consumer Staples had the largest decrease of 1.08%, followed by Energy with a decline of 0.94%. Health Care experienced a decrease of 0.67%, while Materials and Utilities both had losses of 0.59% and 0.39% respectively. Communication Services and Industrials also showed declines of 0.07% and 0.23% respectively. Financials remained unchanged at 0.00%.

The EUR/USD currency pair showed signs of recovery from its 10-week lows on Tuesday, although there is a possibility that it may be influenced by the “sell in May and go away” stock market adage if U.S. data continue to outperform and investors continue to reduce their expectations of a Federal Reserve interest rate cut.

These rate cut bets had increased during the U.S. regional banking crisis but have been diminishing and could decrease further if the debt limit deal is approved. The Federal Reserve’s cautious stance on rate hikes during the banking crisis and debt ceiling issue has eased, contributing to a 4.5% rebound in the dollar index since early May. However, it remains below the peak reached before the banking crisis.

The EUR/USD’s slight gain on Tuesday, despite a more bearish outlook, may only be a temporary bounce driven by month-end and pre-U.S. payroll book-squaring activities. The currency pair experienced a significant bearish reversal in May and is expected to retrace at least a portion of its recovery from 2022-23. The USD/JPY and EUR/JPY pairs both declined, with the yen gaining strength due to stable Japanese government bond yields compared to falling Treasury and bund yields following the debt ceiling deal.

The USD/JPY also fell after reaching six-month highs as yen short positions became cautious following a meeting between the U.S. and Bank of Japan, which hinted at the possibility of FX intervention to support the yen if necessary. This intervention is viewed more seriously due to previous interventions in late 2023 that resulted in yen weakness and inflation surpassing the Bank of Japan’s 2% target. Sterling gained while the AUD/USD pair declined on concerns related to China.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| AUD | Consumer Price Index | 09:30 | 6.4% |

| EUR | German Prelim CPI | Tentative | 0.2% |

| CAD | Gross Domestic Product | 20:30 | -0.1% |

| USD | JOLTS Job Openings | 22:00 | 9.41M |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.