Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

On Thursday, the S&P 500 and Nasdaq Composite experienced gains driven by positive quarterly results from Nvidia, leading to a surge in technology stocks. The Nasdaq rose by 1.71% to close at 12,698.09, while the S&P 500 increased by 0.88% to finish at 4,151.28. However, the Dow Jones Industrial Average declined slightly by 0.11% to close below its 200-day moving average at 32,764.65.

Nvidia’s shares soared by 24.4% after the company reported better-than-expected revenue guidance and strong performance in the previous quarter. The increasing demand for Nvidia’s chips in artificial intelligence applications contributed to its success.

Following these results, several analysts raised their price targets for Nvidia, bringing the company’s market capitalization close to $1 trillion. Other semiconductor and artificial intelligence stocks, such as Advanced Micro Devices, Taiwan Semiconductor, Alphabet, and Microsoft, also experienced notable gains.

Despite the positive market performance, concerns about market breadth persisted, with some companies and sectors driving the market higher while others struggled. Additionally, negotiations to raise the U.S. debt ceiling continued, causing some uncertainty in the market.

Talks between congressional leaders and President Joe Biden showed progress, but concerns remained as the default deadline approached. Fitch Ratings put the U.S.’ AAA long-term foreign-currency issuer default rating on a negative watch, citing the risk of missed payments on government obligations.

Data by Bloomberg

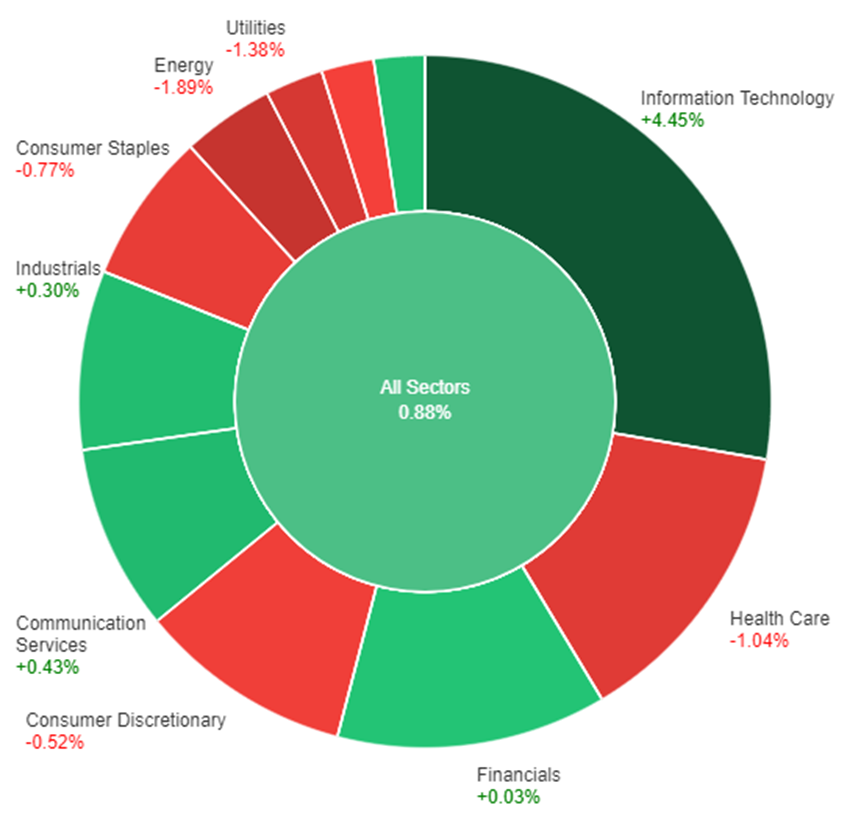

On Thursday, the overall market experienced a positive price change of 0.88%. The Information Technology sector performed exceptionally well, with a significant increase of 4.45%. Communication Services also saw a modest gain of 0.43%, followed by the Industrials and Real Estate sectors, which both experienced slight increases of 0.30% and 0.28%, respectively. The Financials sector showed minimal growth with a 0.03% increase.

However, several sectors experienced declines on Thursday. The Materials sector saw a decrease of 0.38%, while the Consumer Discretionary sector suffered a larger decline of 0.52%. The Consumer Staples sector had a notable drop of 0.77%. The Health Care sector experienced a significant decrease of 1.04%, and the Utilities and Energy sectors had the largest declines, with decreases of 1.38% and 1.89%, respectively.

Major Pair Movement

On Thursday, the dollar index performed strongly, supported by haven buying due to ongoing uncertainties surrounding U.S. debt ceiling negotiations. Additionally, positive U.S. economic data, including tight initial jobless claims, upbeat GDP, and core PCE data, have raised expectations of a Federal Reserve interest rate hike in July.

This has diminished the previously anticipated rate cuts for the end of the year. While a resolution to the debt ceiling issue was expected by Friday afternoon, U.S. Treasury Bill rates remained elevated.

In the currency markets, the euro lost 0.2% against the dollar, primarily driven by the strength of the dollar due to rising interest rate expectations. The dollar’s safe-haven status remained intact as credit agencies warned of a possible downgrade of the U.S. sovereign rating.

USD/JPY broke above a key Fibonacci resistance level, reaching a high of 139.96, benefiting from widening U.S.-Japan rate differentials. The Bank of Japan’s Governor commented on potential adjustments to the Yield Curve Control (YCC) program, focusing on shorter maturities, but it had a limited impact on the rising USD/JPY trend.

Meanwhile, GBP/USD experienced a slight decline of 0.33% as weak UK CBI data and concerns over fading UK economic performance overshadowed rising UK rates. Gold prices fell by 0.75% to $1,942 as speculators lightened their gold hedges in anticipation of a potential debt ceiling deal and took advantage of higher yields.

Bitcoin remained relatively flat at $26.4k, finding support near the lower 30-day Bolli band around $25.7k, while a close below the 50% Fibonacci level at $25.3k could potentially lead to a further decline towards the 200-day moving average at $22.7k.

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| USD | Core PCE Price Index m/m | 20:30 | 0.3% |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.