Spreads

Spreads

Spreads

Spreads

Spreads

On Friday, the DXY was able to recover from its earlier low point as the bears were unable to retest or breach the support level of 101.00. However, the USD index was still facing downward pressure despite a bullish move on Thursday.

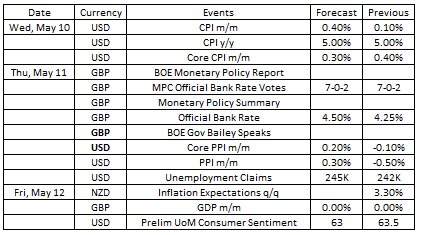

This week, highly anticipated economic reports are set to be released, including the Bank of England Rate Statement, US Consumer Price Index, and Producer Price Index. These reports are vital, providing traders and investors with informed decision-making data and ensuring they stay ahead of the dynamic market.

Consumer Price Index | US (May 10)

CPI in the US rose by 0.1% in March 2023, showcasing a slowdown in increment from February’s 0.4% increase.

According to analysts, the CPI reading for April is expected to rise by 0.3%.

Takeaway: Following the negative market reaction to the Fed rate decision, the market will now be closely watching the Consumer Price Index (CPI). If the results align with the forecast, we can anticipate a slight boost in the US dollar.

Bank of England Rate Statement | UK (May 11)

During its March 2023 meeting, the BoE raised its key bank rate by 25bps to 4.25%, with the objective of bringing inflation back to the 2% target.

Some analysts expect the next rate hike will be by another 25bps to 4.50%.

Takeaway: Based on last month’s hawkish inflation and wage data, the BoE is expected to implement another 25 basis-point rate hike. However, due to recent comments by the bank on the delayed impact of prior tightening measures, the criteria for further actions have increased. Unless there is negative economic news in the next few weeks, we predict that there will be a pause in June.

Producer Price Index | US (May 11)

Producer prices for final demand in the US decreased by 0.5% month-on-month in March 2023, the largest drop since April 2020.

An increase of 0.3% is expected for April.

Takeaway: Following the negative reaction of the market to the Fed rate decision, the focus now shifts to the Producer Price Index (PPI). If the result aligns with the forecast, we can anticipate a slight boost for the US dollar.

Gross Domestic Product | UK (May 12)

The UK economy experienced a halt in February 2023, after achieving an upwardly revised growth of 0.4% in January.

For March, the country’s GDP is expected to expand by 0.1%.

Takeaway: The Bank of England will rely on the latest UK GDP figures to help determine their next interest rate decision. The release of this data, if it’s in line with expectations, could potentially slow down the GBPUSD exchange rate. However, it could also signal the central bank to keep the interest rate unchanged in the next meeting.

Prelim University of Michigan Consumer Sentiment | US (May 12)

The University of Michigan’s US consumer sentiment came in at 63.5 in April 2023, up from 62 in March.

For May, analysts expect a reading of 64.

Takeaway: The market closely watches consumer sentiment as it serves as an indicator of the public mood in the US. If the data release meets the forecast, we may see a boost for the US dollar.