Spreads

Spreads

Spreads

Spreads

Spreads

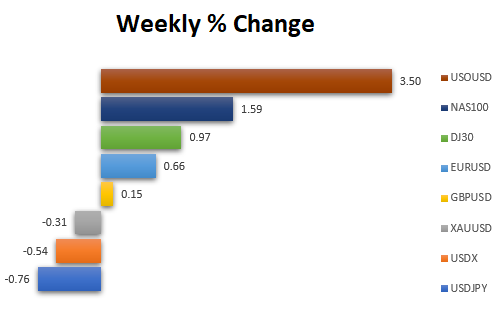

The USD experienced a slight decrease in value last week due to market sentiment.

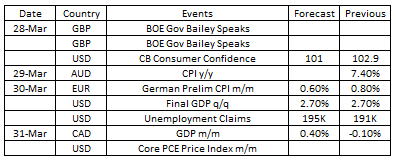

As we approach the end of the first quarter of 2023, several countries are set to release their economic data for the week. The United States will be releasing their Consumer Confidence and Core PCE Price Index reports, while Australia and Germany will release their CPI reports. Additionally, Canada will be providing their GDP figures for the period. Analysts and investors eagerly anticipate these reports as they provide valuable insights into the current state of the economy and can have an impact on financial markets.

Here are key events to watch out for:

CB Consumer Confidence | US (March 28)

The US CB Consumer Confidence fell to 102.9 in February 2023.

Analysts anticipate it to drop further to 101 in March 2023.

Consumer Price Index | Australia (March 29)

Australia’s monthly CPI rose 7.4% in January 2023, but still lower than the 8.4% rise for the year to December 2022, signifying stubborn high inflation.

For February 2023, analysts expect it to increase by 7.6%.

Prelim Consumer Price Index | Germany (March 30)

The CPI in Germany increased 0.8% in February 2023, easing from a 1% rise in the previous month.

For March 2023, analysts expect the index to increase by 1.5%.

Gross Domestic Product | Canada (March 31)

Canada’s GDP shrank by 0.1% in December 2022, following a 0.1% increase in November 2022. Analysts expect the Canadian economy to increase by 0.3% in January 2023.

Core PCE Price Index | US (March 31)

Core PCE prices in the US, which exclude food and energy, jumped by 0.6% month-on-month in January 2023, the most since August, following an upwardly revised 0.4% increase in the previous month.

For February, analysts expect the index to increase by 0.6%.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.