Spreads

Spreads

Spreads

Spreads

Spreads

Jerome Powell’s hawkish rhetoric triggered a surge in Federal Reserve rate expectations, sparking concerns of a potential recession and causing a sell-off in the riskier segments of the market, resulting in Wall Street experiencing a reality check. During a Senate hearing, Powell suggested that the Fed may accelerate the pace of tightening and raise interest rates if inflation continues to soar. According to the CME FedWatchTool, the market now predicts a potential half-point hike in March and estimates the peak rate to reach around 5.6%. Additionally, the US 2-year yield surpassed the 10-year yield by one percentage point, indicating a curve inversion, which can be a sign of a looming recession.

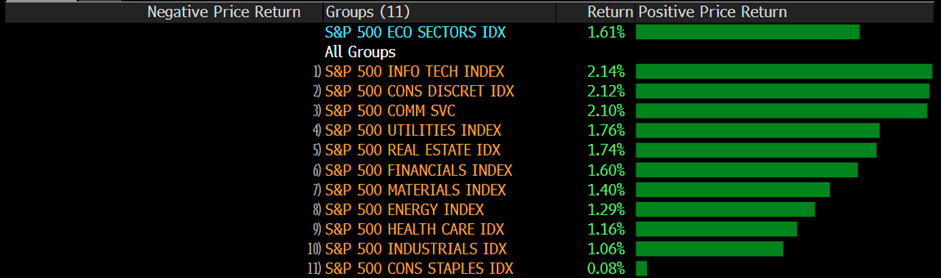

As a result, the S&P 500 tumbled below 4,000, and all eleven sectors of the S&P500 remained bearish. The Financial and Real Estate sectors were hit the hardest, declining by more than 2% each, while the Nasdaq 100, Dow Jones Industrial Average, and MSCI world index fell by 1.2%, 1.7%, and 1.5%, respectively. The sudden sell-off showed that the stock market was surrounded by bearish traction across the board, with no sector showing positive performance. The current situation in the market has raised concerns among investors, who fear that the economy may be heading toward a recession, especially since curve inversions are often seen as a potential harbinger of a recession.

Main Pairs Movement

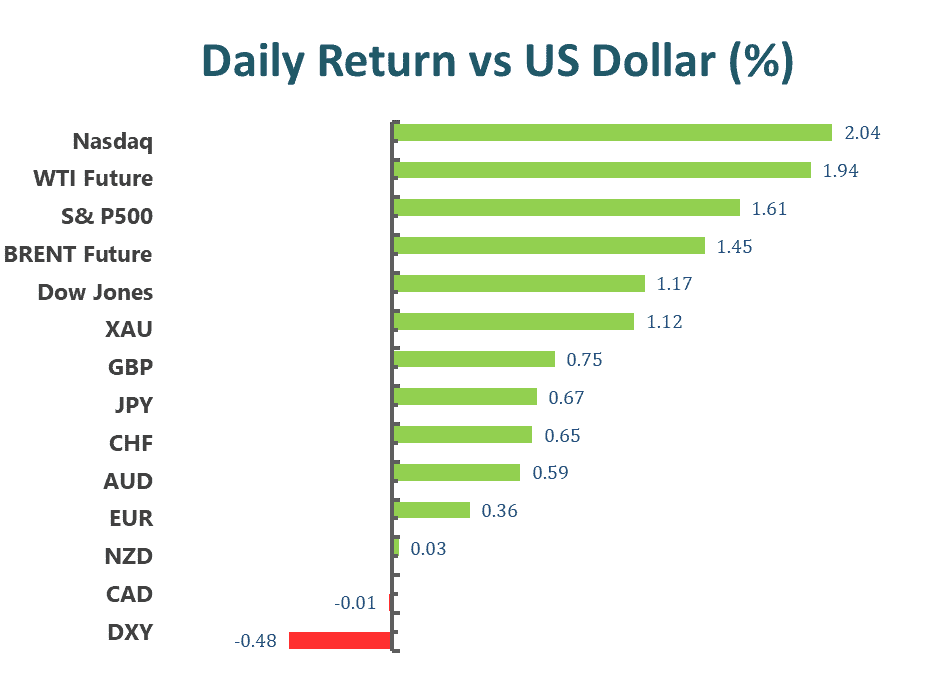

The US dollar surged to a three-month high, marking its most significant gains since early October 2022. This unexpected rise was due to Fed Chair Powell’s surprising readiness for more rate hikes and bolstered bets of a 50 bps Fed rate hike in March. These remarks propelled “higher for longer” Fed rate expectations, bolstered US Treasury bond yields, and negatively impacted equities.

In particular, GBPUSD experienced a 1.62% drop as Powell’s hawkish testimony, Brexit concerns, and BoE rate hike worries weighed on Cable bears, causing the pair to fall sharply by almost 0.9% following Powell’s speech. Meanwhile, EURUSD also tumbled by 1.22% on Tuesday.

Additionally, XAUUSD witnessed a 1.82% drop on a daily basis, with gold prices being highly susceptible to the possibility of a firmer 50 bps rate hike from the Federal Reserve. As a result, the price of gold continued to decline throughout the trading session, experiencing almost 1% in losses within an hour.

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| EUR | ECB President Lagarde Speaks | 18:00 | |

| USD | ADP Nonfarm Employment Change (Feb) | 21:15 | 200K |

| USD | Fed Chair Powell Testifies | 23:00 | |

| USD | JOLTs Job Openings (Jan) | 23:00 | 10.500M |

| CAD | BoC Interest Rate Decision | 23:00 | 4.50% |

| USD | Crude Oil Inventories | 23:30 | 0.395M |