Spreads

Spreads

Spreads

Spreads

Spreads

EURUSD (4-Hour Chart)

On Tuesday, the EUR/USD pair plummeted below the 1.0580 level, recording a 0.92% loss for the day. The renewed strength of the US dollar, supported by the recovery of the US 10-year Treasury bond yield, pushed the pair into negative territory after Fed Chair Powell’s hawkish speech. Powell’s remarks about increasing the pace of rate hikes and a higher terminal rate than previously anticipated prompted the market to raise the odds of a 50 basis points rate hike at the March FOMC meeting to 50%. Meanwhile, investors in the Eurozone are anticipating more rate hikes from the ECB amid fears of higher inflation.

From a technical perspective, the RSI indicator and Bollinger Bands suggest a downside trend, with the pair testing the 1.0576 support line and the risk skewing to the downside if it falls below that level.

Resistance: 1.0686, 1.0790

Support: 1.0576, 1.0540, 1.0508

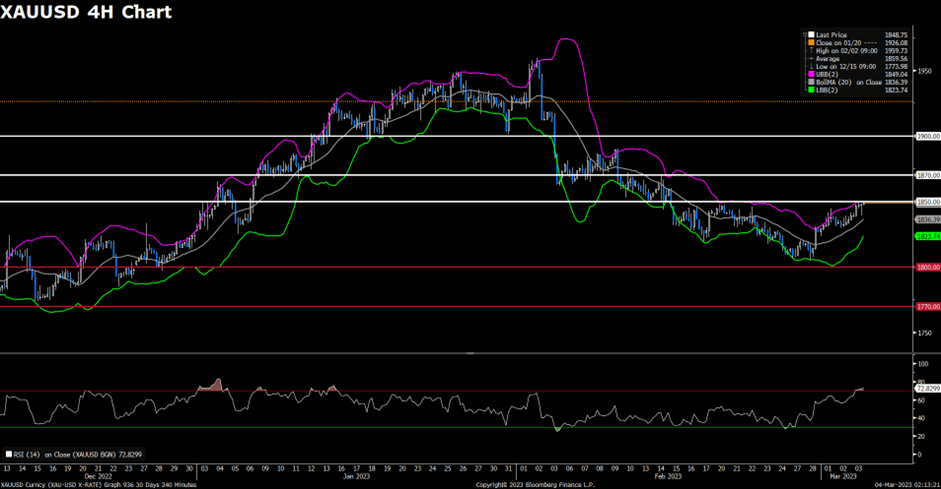

XAUUSD (4-Hour Chart)

Powell’s hawkish remarks have caused the gold price to drop below $1,820, reaching $1,815 at the moment. Market participants viewed Powell’s speech as hawkish, causing the chance of a 50 basis points rate hike to jump to nearly 50%. Gold prices continued to decline despite US yields moving off lows, as a stronger greenback and risk aversion influenced the market.

From a technical perspective, the gold price dropped by about 1.69% on the daily chart and is approaching the bottom of the range. The price is back below a bearish 20 SMA, which is currently converging with the 23.6% retracement of the latest decline at $1,841.05. On the four-hour chart, the gold price is developing below all its moving averages, with the 20 SMA gaining downtrend traction between the longer ones. Additionally, technical indicators are well below their midlines, indicating sustained selling interest.

Resistance: 1,829.90 1,841.05 1,858.30

Support: 1,804.70 1,789.60 1,774.20