Spreads

Spreads

Spreads

Spreads

Spreads

US stock rallied on Wednesday, snapping a two-day loss since the beginning of this week, as earnings buoyed the market mood. Investors could clear their concerns about earnings disaster after 70% through the season, as more cheering data like a solid report from Moderna.Inc and Paypal Holding Inc. released.

However, Jerome Powell signalled that the pace of future rate increases may slow later this year, which boosted the speculations for cuts next year in market-implied measures, as even several Fed leaders said central banks still keep their eyes out for the hottest inflation in four decades. Moreover, after House Speaker Nancy Pelosi left Taiwan, the market is calmer amid the undermining relationship between China and the United States.

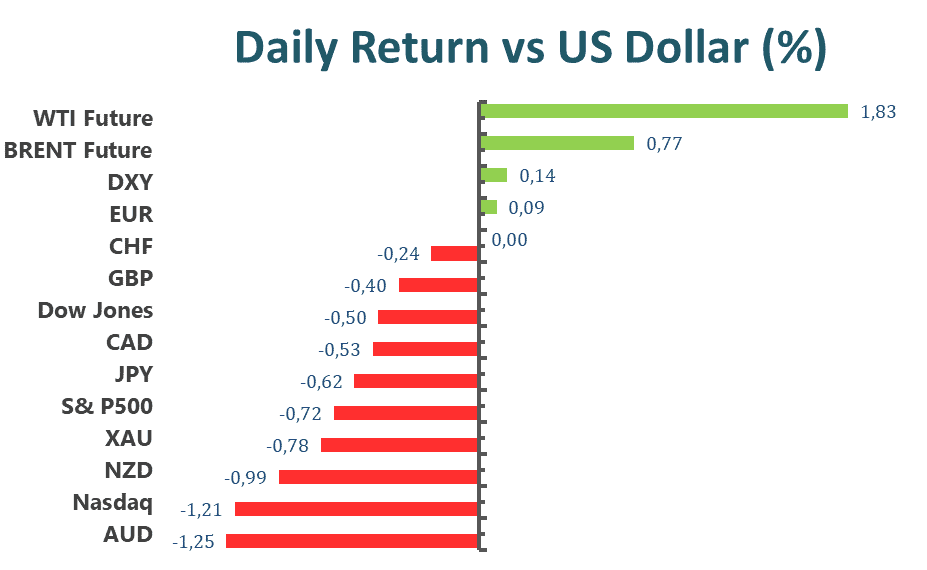

The benchmarks, S&P500 and Dow Jones Industrial Average both advanced on Wednesday as tech earnings performed better than expected. S&P500 rose with a 1.56 % gain on a daily basis, and ten out of eleven sectors stayed in positive territory, as Information Technology, Consumer Discretion, and Communication Service got the best performance, with a 2.69%, 2.52% and 2.48% growth rate respectively for the day. Besides, the Dow Jones Industrial Average rose 1.3%, Nasdaq 100 rose 2.7%, but the MSCI world index slid with a 0.8% loss on Wednesday.

Main Pairs Movement

US dollar rose on Wednesday, as the upbeat prints of US data and hawkish comments from the Fed mixed with recession fears put a firm floor for the safe-haven greenback. The DXY index surged at the beginning of the US trading session as stronger than forecast earnings were released, but lost bullish momentum and reversed from a weekly top to a depressed around 106.5 level. It’s worth noting that, US ISM Services PMI for July rose to 56.7 from 55.3, far above the market expectation of 53.5, and the Final reading of the US S&P Global Services PMI for July dropped to 47.3, which is the first contraction in two years.

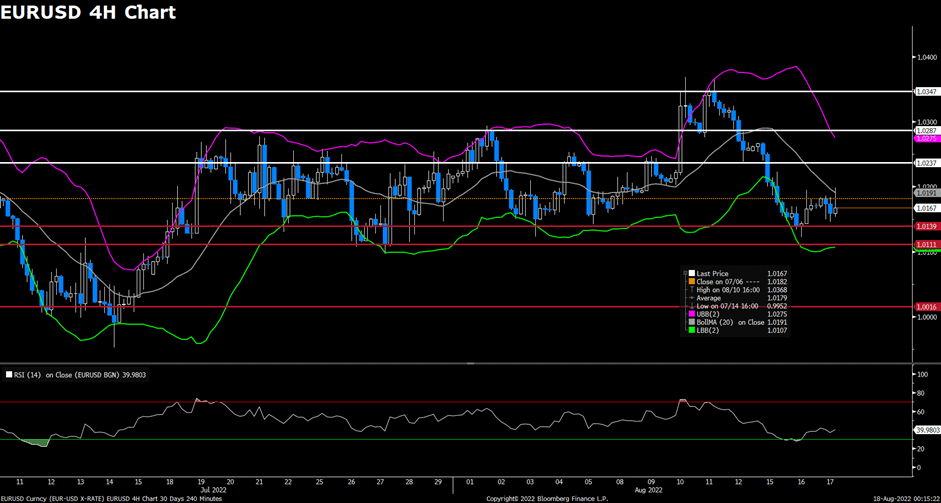

The GBP/USD slid for the day, market amid a strong US dollar across the board and the expectation of a 50-bps rate hike by the Bank of England (BOE), however, the price pressure has risen up to 9.4%. The cables suffered selling during the selling pressure as upbeat US data and US stock and to a daily low level around 1.210. Meanwhile, EURUSD dropped to a daily low level below 1.013, then regain bullish momentum back to a 1.016 level. The pairs remained unchanged on Wednesday.

Gold advanced with a 0.28% gain on a daily basis and closed at $1765 marks for the day. However, investors put focused on upbeat US data and comments from Fed during the US trading session, which caused the XAUUSD to fall below the $1755 mark. It’s also worth noting that WTI and BRENT oil dropped 3.74% and 3.98% respectively.

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| GBP | Construction PMI (Jul) | 16:30 | 52.0 |

| GBP | BoE Interest Rate Decision (Aug) | 19:00 | 1.75% |

| GBP | BoE Gov Bailey Speaks | 19:30 | |

| USD | Initial Jobless Claims | 20:30 | 259K |