Spreads

Spreads

Spreads

Spreads

Spreads

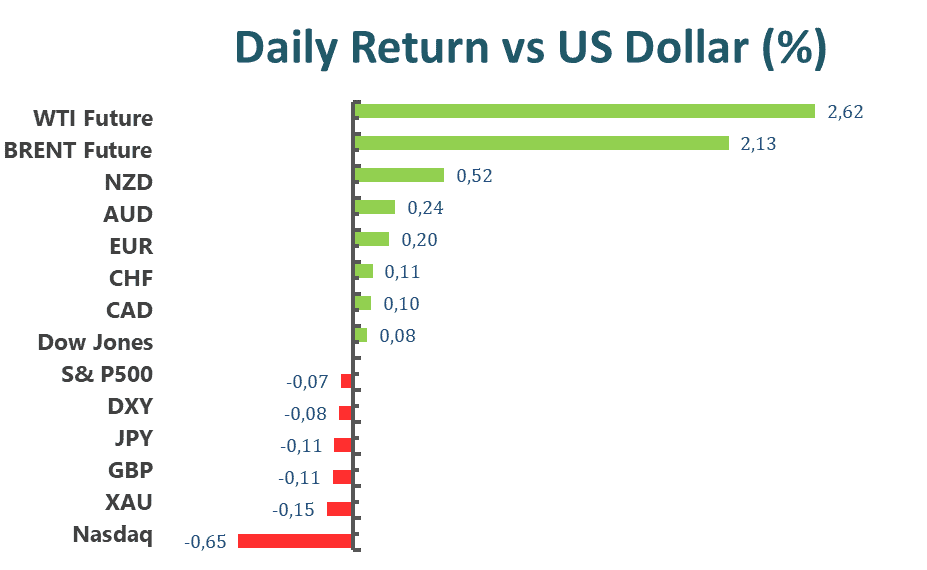

US stock little declined on Tuesday, as Federal Reserve officials implied the next move of the central bank will be more hawkish to calm runaway inflation. Investors are keeping their eyes out for comments from Fed officials about the necessity of a more aggressive interest rate policy. It’s also worth noting that, Pelosi’s trip has created new geopolitical tensions for investors already consuming the prospects of the US recession, global interest rate hikes and Russia’s war in Ukraine. Fresh economic data also showed that US openings in June fell to a nine-month low, which is a signal to tell investors that demand for the labour market is moderating as higher economic pressure.

The benchmarks, S&P500 and Dow Jones Industrial Average both slid on Tuesday. S&P 500 fell with a 0.67 % losses on a daily basis as Nancy Pelosi’s arrival in Taiwan prompted China to do missile test, undermined the geopolitical tensions, and all eleven sectors stayed in negative territory as Real Estate and Financial sectors performed worst among all groups, falling 1.3% and 1.07% respectively. Moreover, the Dow Jones Industrial Average dropped 1.1% for the day, Nasdaq has little changed with 0.3% losses and the MSCI world index rose 0.1% on Tuesday.

Main Pairs Movement

US dollar surged with a 0.85% gain on Tuesday, the market is surrounded by a risk-aversion mood as tensions caused by the news of US House Speaker Nancy Pelosi’s visit to Taiwan. The DXY index eased at the beginning of Tuesday, but regain bullish momentum after the hawkish comments from Federal Reserve officials, which resumed the consecutive days’ losses and back to the level above 106.1.

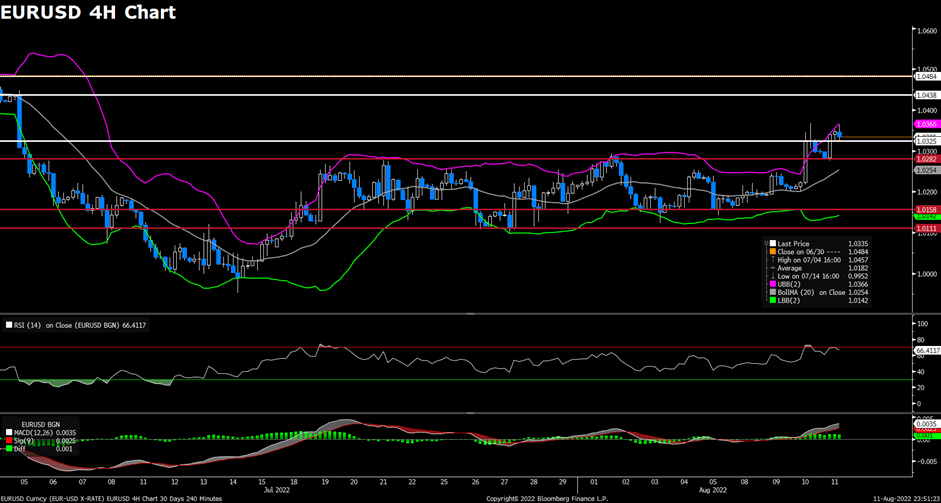

The GBP/USD dropped 0.65% for the day, as the market amid a risk-aversion mood and a strong save greenback across the board. The cables slip almost all day on Tuesday, as a huge selling pressure caused by Pelosi’s trip may undermine the relationship between US and China. The GBPUSD touched a daily low level during the US trading session around 1.218. Meanwhile, EURUSD also lost the previous day’s gain and fell back to a level under 1.018 at end of the day. The pairs dropped 0.94% on Tuesday.

The Gold declined by 0.66% daily as the risk aversion market makes a save greenback strong across the board and US yields have rallied recently weighing on the gold price. WTI and Brent oil rose 0.56% and 0.51% on Tuesday.

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| AUD | Retail Sales (MoM) | 09:30 | 0.2% |

| GBP | Composite PMI (Jul) | 16:30 | 52.8 |

| GBP | Services PMI (Jul) | 16:30 | 53.3 |

| USD | ISM Non-Manufacturing PMI (Jul) | 22:00 | 53.5 |

| USD | Crude Oil Inventories | 22:30 | -0.629M |