Spreads

Spreads

Spreads

Spreads

Spreads

US stock continued to stay in negative territory but closed above session lows as Federal Reserve officials’ comments have eased investors’ concerns about a recession caused by the aggressive pace of monetary tightening. Federal Reserve Governor Christopher Waller said that markets may have gotten ahead of themselves by pricing a 100 basis points rate hike in July, adding that they would back a 75 bps rate hike after a hot inflation report. Therefore, traders shifted their bets away from a 100 bps rate hike by the Fed this month, but people are now confused that where the economy is heading and whether we are going into recession. In the Eurozone, the Russian energy giant Gazprom said that it would not guarantee to resume the functioning of the Nord Stream 1 pipeline after it was shut down for repairs. The uncertainty around gas deliveries is weighing on Europe’s economic outlook.

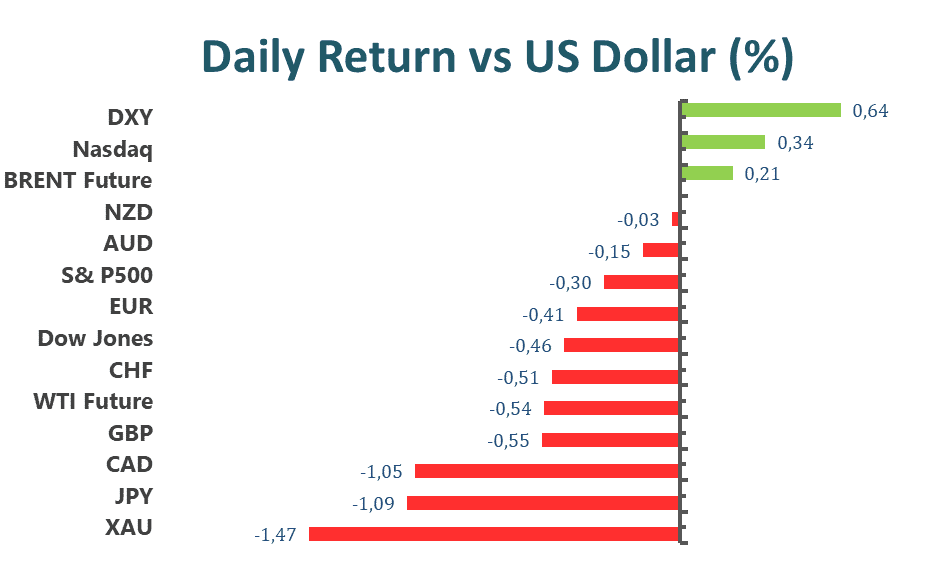

The benchmarks, S&P 500 and Nasdaq 100 both dropped on Thursday as the equity market stayed under pressure amid high inflation and fears of a global recession. The S&P 500 was down 0.3% daily and the Nasdaq 100 also declined with a 0.3% loss for the day. Eight out of eleven sectors stayed in negative territory as the financials and the energy sectors are the worst performings among all groups, losing 1.92% and 1.90%, respectively. The Dow Jones Industrial Average meanwhile declined the most with a 0.5% loss on Thursday and the MSCI World index fell 0.8%.

Main Pairs Movement

The US dollar edged higher on Thursday, continuing to derive support from the fears of a recession and refreshing its 20-year high above 109 level. The DXY index was surrounded by bullish momentum during the first half of the day but then retreated to erase some of its daily gains in the US trading session. The comments from Fed officials yesterday have cooled down expectations of a 100 bps rate hike in the US and triggered a corrective slide witnessed in the US dollar.

GBP/USD declined with a 0.57% loss on Thursday amid the risk-off market mood across the board. Political news in the United Kingdom has exerted some bearish pressure on the cable, as UK Prime Minister announced his resignation and Tories began an election process. The GBP/USD remained under bearish momentum and dropped to a daily low below the 1.177 mark, then rebounded slightly back to recover its daily losses. Meanwhile, EUR/USD preserved its downside traction and plunged to 0.9951 before recovering some ground and trimming its earlier losses in the US session. The pair was down almost 0.45% for the day.

Gold tumbled with a 1.48% loss for the day after dropping to a daily low below the $1700 mark in the early US trading session, as the rising US dollar and hawkish sentiment surrounding the Fed continued to drag the precious metal lower. Meanwhile, WTI oil regained upside traction and climbed back to the $96 area during the second half of the day.

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| CNY | GDP (YoY) (Q2) | 10:00 | 1.0% |

| CNY | Industrial Production (YoY) (Jun) | 10:00 | 4.1% |

| USD | Core Retail Sales (MoM) (Jun) | 20:30 | 0.6% |

| USD | Retail Sales (MoM) (Jun) | 20:30 | 0.8% |

Note: The information is provided for reference purposes only and doesn’t take into account your personal objectives, financial circumstances, or needs, and does not constitute investment advice. We encourage you to seek independent advice if necessary. VT Academy will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.