Spreads

Spreads

Spreads

Spreads

Spreads

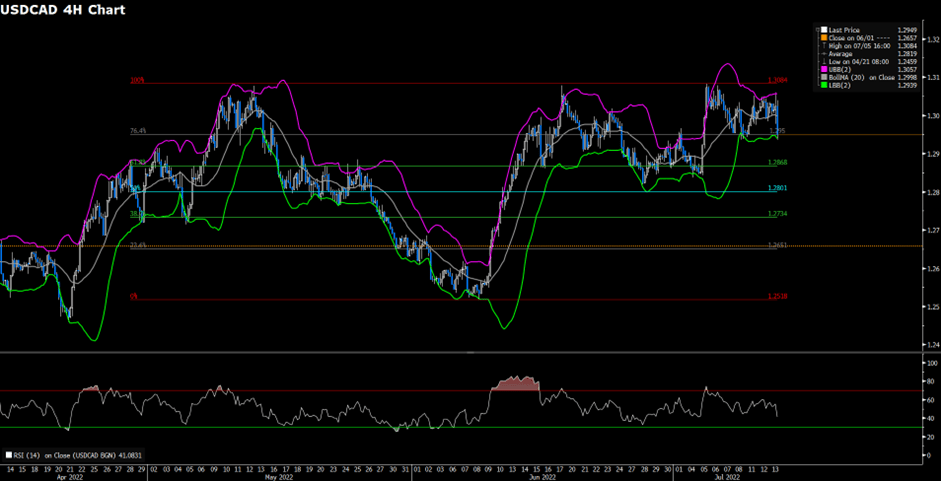

USDCAD fell sharply after the Bank of Canada decides to raise interest rates by 100 basis points to 2.5%.

From the technical aspect, the intraday bias turns bearish on the four-hour chart as the bearish double-top pattern has been formed. And the downside is currently contesting the support level of 1.295; the breakout of 1.295 would bring a deeper fall back to the next support of 1.2868. To the upside, suitably holding above current support should favour the USD; climbing above the midline of Bollinger Band could lead the USD back in control and reclaim its upside momentum.

Resistance: 1.3084

Support: 1.295, 1.2868, 1.2801

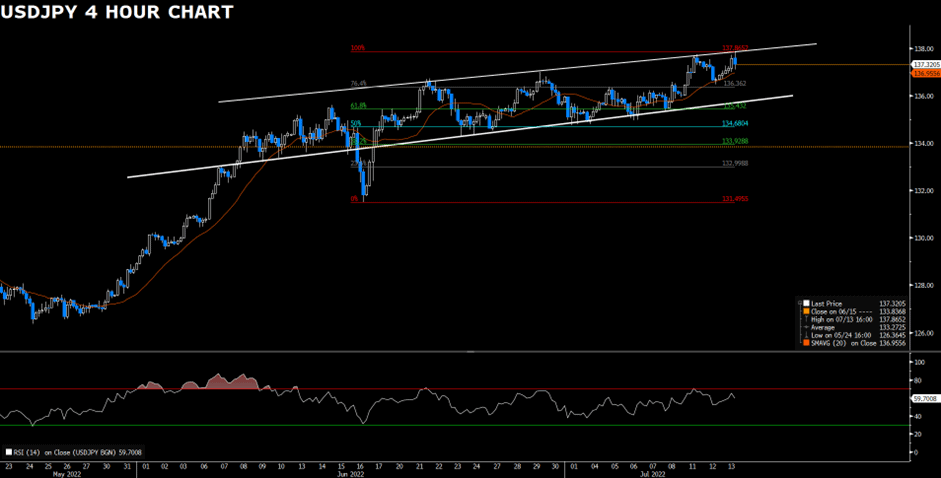

USDJPY edges higher toward its 24-year peak at the time of writing following the record-high US CPI report. In the meantime, the Bank of Japan hints at further stimulus, thus hurting the demand for the Japanese Yen.

Technical speaking, the intraday bias turns bullish after USDJPY hits the 20 Simple Moving Average; the 20 SMA becomes the first defending support for the bulls. The breakout of the resistance level of 137.86 would bring the currency further north. The current reading of the RSI indicator has not yet reached the overbought territory, suggesting that there are rooms for the pair to extend the rally. On the flip side, the support level of 135.43 would be the region that bearish momentum needs to break to bring USDJPY to the bearish projection.

Resistance: 137.86

Support: 136.36, 135.43, 134.68

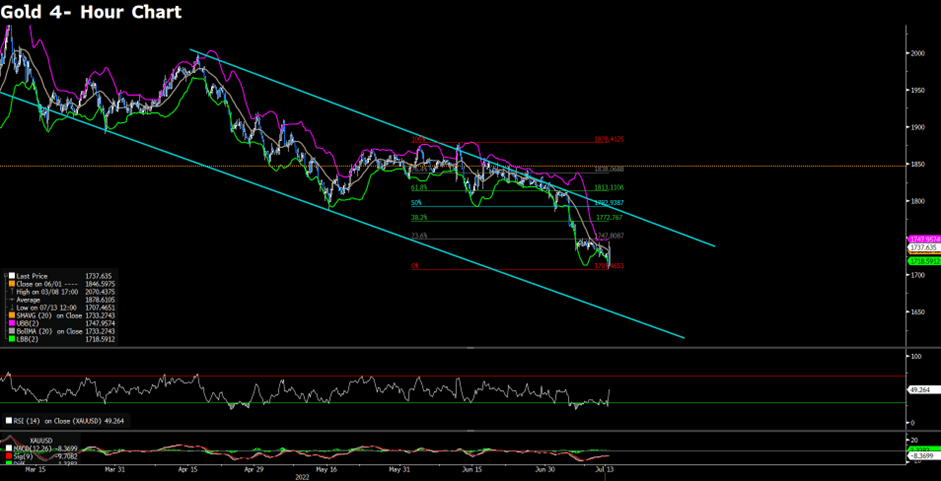

Gold climbs near $1,740 after the release of the US CPI report, reaching 9.1% in June, its highest in nearly 40 years. An unprecedented inflation rate in June benefits the upside of gold.

From the technical perspective, the intraday rebound has pushed toward the immediate resistance of $1,747.80; with the RSI still far from being overbought, it might attract some follow-through buyers, boosting gold’s price further north. On the contrary, any up- surges would urge caution from the upcoming trading as the overall outlook of gold still looks bearish since gold still trades within the descending channel.

Resistance: 1747.80, 1772.76, 1792.93

Support: 1707.46

Note: The information is provided for reference purposes only and doesn’t take into account your personal objectives, financial circumstances, or needs, and does not constitute investment advice. We encourage you to seek independent advice if necessary. VT Academy will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.