Spreads

Spreads

Spreads

Spreads

Spreads

Stocks slumped on Monday, with trades positioning for a high inflation reading and the start of a key earnings season that could provide clues as to whether the economy is heading for a recession. On the trade of the day, the dollar climbed, and a sell-off in mega-caps like Tesla Inc. and Apple Inc. weighed heavily on the equity market. Twitter Inc. plunged 11% as Elon Musk give up his $44 billion deal to buy the company, setting a predictable legal battle with Twitter.

The benchmarks, S&P 500 and Nasdaq 100 both slumped on Monday as investors are waiting to see

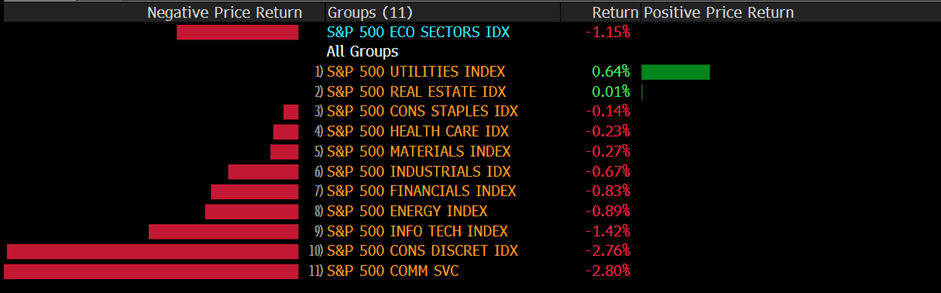

if profits are holding up or if companies will cut forecasts significantly amid widespread economic challenges. Nine out of eleven sectors of S&P 500 closed negative in the trade of the day as the COMM SVC and the CONS DISCRET are the worst performing sectors among all groups, losing 2.76% and 2.80% respectively. The S&P 500 fell 1.2% as of 4 p.m. New York time. The Nasdaq 100 fell 2.2% The Dow Jones Industrial Average meanwhile fell 0.5%.

Main Pairs Movement

The US dollar surged on Monday, continuing its rally and reaching fresh highs against most major rivals amid risk-off sentiment. The DXY index was surrounded by bullish momentum for most of the day, refreshing its daily high above 108.2 level in the late American session. The news showed that inflation in China surged by 2.5% YoY in June, disfavoring the market mood. Moreover, a new coronavirus outbreak has been reported in Shanghai, which may result in fresh lockdowns and potential negative effects on the global economy.

GBP/USD tumbled with a 1.12% loss on Monday amid the stronger US dollar across the board. The risk-averse market atmosphere and growing recession fears both exerted bearish pressure on the cable at the start of the week. The GBP/USD pair witnessed heavy selling during the first half of the day, then rebounded slightly to recover some of its daily losses. Meanwhile, EUR/USD remained under bearish pressure and refreshed its fresh 20-year low at 1.003 during the US session. The pair was down almost 1.36% for the day.

Gold declined with a 0.46% loss for the day after touching a daily low below $1732 during the US trading session, as the US dollar continued to find safe-haven demand and edged higher against its most major rivals. Meanwhile, WTI oil extends its pullback and retreated to the $103 area amid fears of slower demand.

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast | |

| EUR | German ZEW Economic Sentiment (Jul) | 17:00 | -38.3 | |

| EUR | German Buba President Nagel Speaks | 17:30 | N/A | |

| USD | OPEC Monthly Report | 19:00 | N/A | |

| INR | CPI (YoY) (Jun) | 20:00 | 7.03% |

Note: The information is provided for reference purposes only and doesn’t take into account your personal objectives, financial circumstances, or needs, and does not constitute investment advice. We encourage you to seek independent advice if necessary. VT Academy will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.