Spreads

Spreads

Spreads

Spreads

Spreads

US stocks rose for three days in a row, as investors parsed economic data that hinted at slower growth, which also prompted some to brush off the hawkish stance reiterated by Fed in June meeting minutes. All eyes need to be on the Fed, officials ‘’agreed” last month that interest rates may need to keep rising for longer to against entrenching inflation.

However, data released Wednesday showed that US job openings dipped slightly in May but remained near a record, and the growth in the US services sector also eased in June to a two-year low. This prompted some traders convinced that Fed’s stance has a little too real market situation.

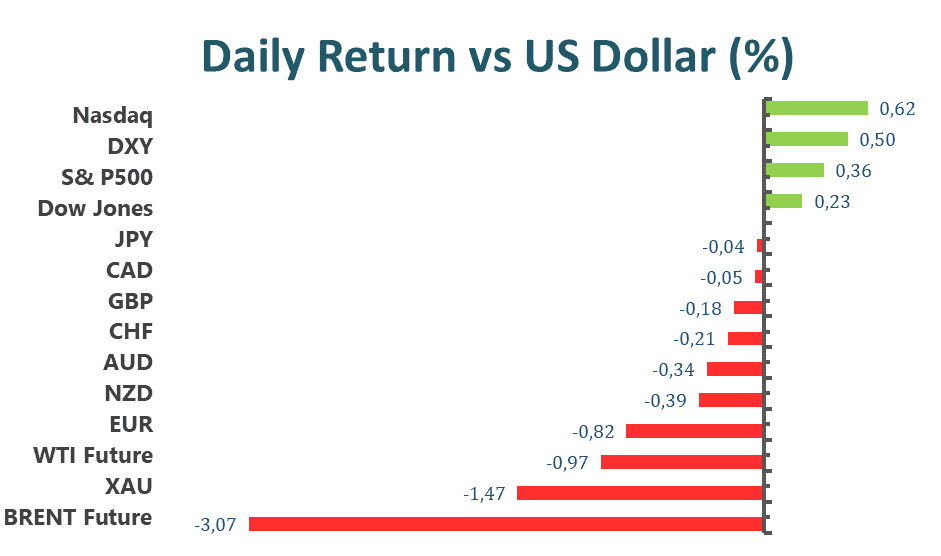

On the benchmark side, both S&P500 and Nasdaq 100 rose on Wednesday although Fed reiterated the hawkish stance in June meeting minutes. S&P500 was up 0.36% daily and the Nasdaq 100 also advanced with a 0.6% gain for the day. In addition, eight of eleven sectors stayed in positive territory as utilities and info tech sectors are the best among all groups, gaining 1.01% and 0.88%, respectively. It is worth noting that, the energy sector remains bad performance on Wednesday and lose 1.74%. The Dow Jones Industrial Average meanwhile increased by 0.2% and the MSCI world index declined by 0.5% on Wednesday.

Main Pairs Movement

The US dollar continued to rise for three straight days, and the DXY index surged up and cling to a 20-year high of 107.05 after the hawkish stance reiterated by Fed. This is a sign of the market still fears the global recession.

The EUR/USD remained bearish, the pair fell to a new 20-year low of 1.0161 at the last hour of Wednesday. Besides the Fed’s hawkish attitude toward US high inflation, the broad pessimism surrounding economic growth, central bankers’ aggregation, and the energy crisis make a downside pressure.

The GBP/USD was also in a bearish momentum despite a bounce-off on late Wednesday from a two-year low around 1.1925. The Cable pairs are still suffering from UK’s political joined Brexit woes and broad recession fears. However, the market anxiety ahead of the Fed’s stance and softer US economic data seems to have probed the bears of late.

Gold has turned into a consolidation phase after a sheer downside move to $1,732 in the NY session. As Fed’s aggressive attitude infused fresh blood into the US dollar, the precious metal suffered a high downside pressure.

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| EUR | ECB President Lagarde Speaks | 19:55 | |

| USD | Nonfarm Payrolls (Jun) | 20:30 | 268K |

| USD | Unemployment Rate (Jun) | 20:30 | 3.6% |

| CAD | Employment Change (Jun) | 20:30 | 23.5K |

Note: The information is provided for reference purposes only and doesn’t take into account your personal objectives, financial circumstances, or needs, and does not constitute investment advice. We encourage you to seek independent advice if necessary. VT Academy will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.