Spreads

Spreads

Spreads

Spreads

Spreads

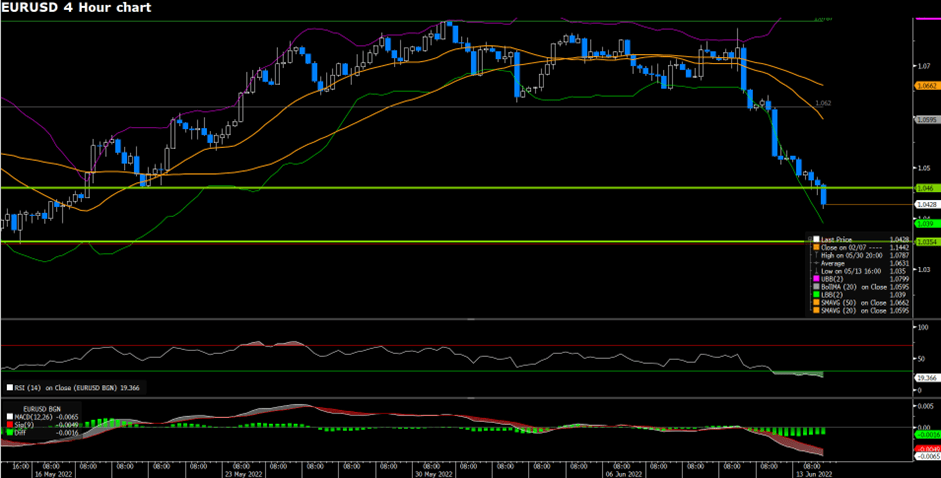

EURUSD continued to plunge on the first trading day of the week. The EURUSD is now on its third consecutive losing day. The Euro has slid more than 2% after the ECB conference held on last Thursday. Inflation and worries over an impending recession have boosted demand for haven assets such as the U.S. Greenback. The U.S. Dollar remains in strong demand as the benchmark 10-year Treasury yield rises past 3.35%.

On the technical side, EURUSD has broken well below our previously estimated support level of 1.064. As of writing, EURUSD is heading towards its lowest level of 2022 and the support level of 1.03783. RSI for EURUSD currently sits at 35.95. On the four-hour chart, EURUSD is trading below its 50, 100, and 200-day SMA.

Resistance: 1.07454

Support: 1.03783

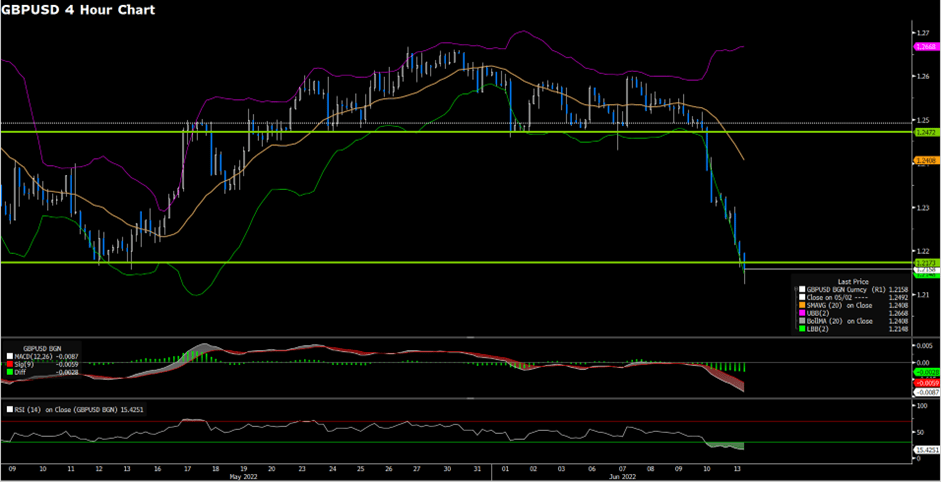

GBPUSD has continued to slide on the first trading day of the week. The British GDP contracted 0.3%, month over month, marking a larger contraction than the previous monthly figure of negative 0.1%. The slowing economy in Britain has agitated market participants as the ECB now faces the possibility of stagflation. The broad-based risk-averse market sentiment has only added fuel to the recent rally of the U.S. Greenback.

On the technical side, GBPUSD has dropped below its May low of 1.21996 and is heading towards two-year-long support at 1.20824. RSI for Cable has dropped to 33.42, as of writing. On the four-hour chart, GBPUSD is currently trading below its 50, 100 and 200-day SMA.

Resistance: 1.25944

Support: 1.20824

USDJPY continued to be traded at extremely elevated levels. The Dollar’s strength has been aided by the soaring U.S. 10-year treasury yield and a broad-based risk-averse environment. BoJ chief Haruhiko Kuroda recently expressed concerns over the sharp drop of the Japanese Yen, however, the Japanese Yen will continue to fare worse against the Dollar as market participants are now pricing in a possible 75 basis point interest rate hike by the Federal Reserve.

On the technical side, USDJPY seems to have hit its near-term resistance level at the 135 price region. A near-term support level at 133.382 has formed, while the lower level of support remains firm. RSI for USDJPY has reached overbought territory and is indicating 74.12, as of writing. On the four-hour chart, USDJPY currently trades above its 50, 100, and 200-day SMA.

Resistance: 134.56

Support: 133.5, 132.5

Note: The information is provided for reference purposes only and doesn’t take into account your personal objectives, financial circumstances, or needs, and does not constitute investment advice. We encourage you to seek independent advice if necessary. VT Academy will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.