Spreads

Spreads

Spreads

Spreads

Spreads

What happened in the market last week?

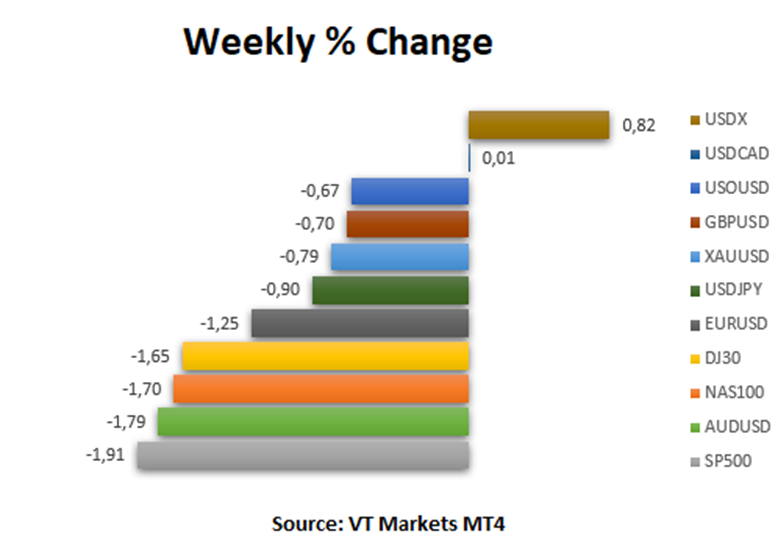

Last Week Market Pair Changes

USD Index (USDX) increased 0.82% as a result of CPI data, which was positive, although investors remained concerned about inflation

After dipping earlier and rising at the end of the week, USOUSD (WTI) decreased 0.67% to close.

US Indices rose on the week’s final trading day, but not enough to offset the week’s decline. The S&P 500, the Dow, and the Nasdaq reported their sixth straight weekly loss. It’s the longest losing streak since 2012 for S&P 500, 2011 for Nasdaq, and 1980 for Dow.

The Australian Dollar fell against the US Dollar throughout the past week. Despite a more hawkish approach for the Reserve Bank of Australia at the beginning of this month, the AUDUSD dropped 1.79%. Risk aversion in financial markets is dragging on the sentiment-linked currency.

EURUSD lost 1.25% in the previous week but rebounded somewhat after reaching a low to close above 1.04. Russia’s decision to restrict gas supplies to Europe has reignited concerns about an economic slowdown in the eurozone and a massive rally in the dollar. This was fuelled by the expectation that the Federal Reserve would implement a series of significant interest rate hikes to combat inflation. Both Bitcoin and Ethereum prices declined, with Bitcoin going below the $25,000 threshold.

(Data taken from MT4 VT Markets)

What to focus on this week?

This week, investors will be looking at retail sales data and retail earnings in the US. Tuesday’s retail sales numbers for April will likely show robust improvements thanks to steady auto sales.

Economists anticipate a 0.8% gain after a 0.7% rise in March, despite increased inflation.

Federal Reserve Chairman Jerome Powell will speak on Tuesday and will likely maintain that the US central bank will boost rates by half a percentage point at its next two meetings.

Investors will also be looking at a flurry of retail earnings reports over the week for clues on how much the cost of living could pressure the purchasing power of consumers.

Top US retailer Walmart (NYSE: WMT) and home improvement giant Home Depot (NYSE: HD) are set to announce fiscal first-quarter profits before the market opens on Tuesday.

Investors will be looking particularly closely at retailers’ guidance for the second half of this year on the back of increased inflation, growing wages and fuel expenses, and persistent supply chain problems.

Wall Street ended higher on Friday following another tumultuous week as worries tempered hopes that inflation may be close to peaking and that aggressive policy tightening by the Fed may tip the economy into recession.

Despite Friday’s advances, the S&P 500 and the Nasdaq reported their sixth weekly loss, while the Dow recorded its seventh consecutive weekly decrease. Investors are looking for clear indicators of a market bottom amid fears the severe selloff in equities may not be done.

Crypto investors are monitoring the aftermath of a significant price crash, led by the steep decline in the value of the TerraUSD stablecoin, which broke its 1:1 peg to the US dollar. Crypto assets have been swept up in a broad selloff of risk assets based on fears over increased inflation and rising interest rates. Still, broader financial markets have experienced little knock-on effect from the crypto crisis.

Meanwhile, the UK and Canada will be reporting inflation data on Wednesday that will likely show consumer prices jumping to 9.1% year-on-year in April, in what would be the highest jump in annual inflation since 1980 and the sharpest pace of inflation since 1982. The Bank of England, while boosting interest rates earlier this month, indicated it expects inflation to soar above 10% in the fourth quarter.

Technical Analysis

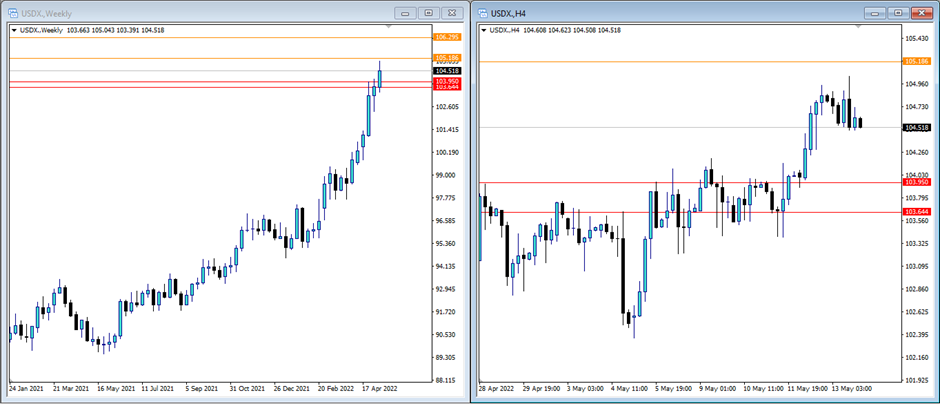

USD Index (USDX)

The USD Index (USDX) strengthened past its highest level since March 2020 at 103.94 and hit a high of 105.04, last seen in December 2002.

USD Index will try to strengthen again with resistance levels at 105.18 and 106.29.

The closest support is at 103.64 and 103.95.

Resistance: 105.18, 106.29

Support: 103.64, 103.95

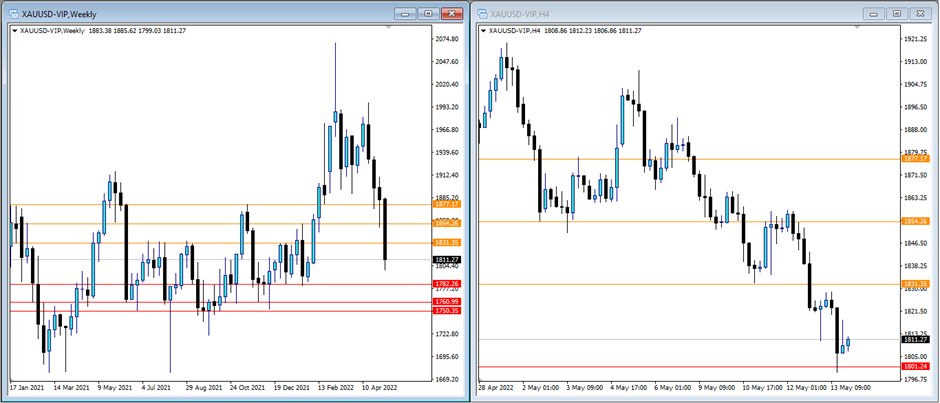

Gold (XAUUSD)

Gold broke past support levels after a weak week to reach below $1800 but bounced back to close at $1811.

This week, we can see that Gold may attempt to break lower again following the positive note in USD. We see that the potential for Gold will continue its decline towards support at $1780, $1760, and $1750.

Meanwhile, in the H4 timeframe, one support level will try to stop Gold’sGold’s decline at the level of $1800.

Our weekly resistance levels are at $1831 and $1854.

Resistance: $1831, $1854

Support: $1782, $1760, $1750