Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

Stocks experienced a decline on Tuesday as discussions regarding the debt ceiling continued with minimal signs of advancement. The S&P 500 dropped 1.12% to settle at 4,145.58, while the Nasdaq Composite pulled back 1.26% to close at 12,560.25. The Dow Jones Industrial Average also lost 0.69%, or 231.07 points, finishing at 33,055.51.

The lack of significant updates on the negotiations left some traders concerned about the lawmakers’ ability to make progress as hoped. Investors have been closely watching the debt-limit negotiations, seeking more certainty as the June 1 X-date, projected by Treasury Secretary Janet Yellen, approaches. Despite the ongoing uncertainty, market stability has impressed experts like Mohamed El-Erian, the chief economic advisor at Allianz, who noted that the S&P 500 remains fairly priced.

While there is an expectation that lawmakers will eventually reach a resolution regarding the debt ceiling, caution prevails due to persistent recession fears and uncertainty surrounding the Federal Reserve’s next rate move. Sandi Bragar, the chief client officer at Aspiriant, emphasized the need for caution, stating that although many investors are eager to participate in the current market conditions, it may not be the time for excessive enthusiasm.

Meanwhile, notable stock movements included Apple’s 1.5% decline following the announcement of a multibillion-dollar chip production deal with Broadcom, and Yelp’s 5.7% increase as an activist investor called for the company to explore a sale.

Data by Bloomberg

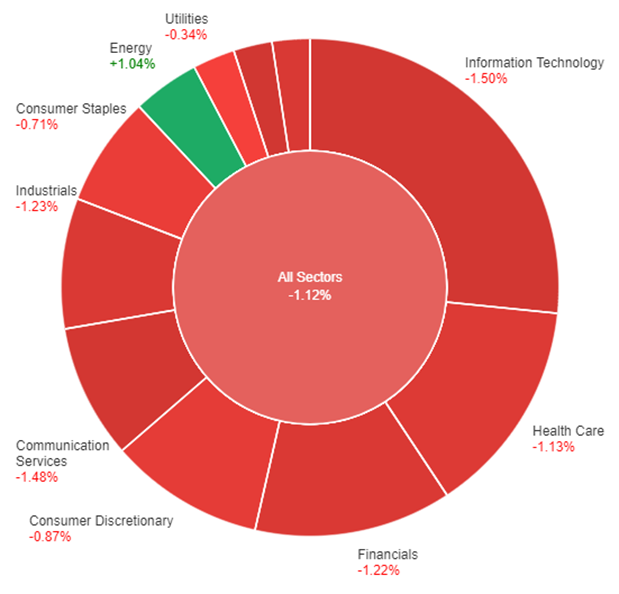

On Tuesday, the stock market saw a general decline across all sectors, with the overall market dropping by 1.12%. The energy sector, however, experienced a slight increase of 1.04%. The utilities sector decreased by 0.34%, while consumer staples and consumer discretionary sectors declined by 0.71% and 0.87%, respectively.

The health care sector faced a larger decline of 1.13%. Financials and industrials both experienced decreases of 1.22% and 1.23%, respectively. Real estate and communication services sectors saw larger declines of 1.28% and 1.48%, while the information technology sector had the largest decline at 1.50%. The materials sector also faced a significant decline of 1.54% on Tuesday.

Major Pair Movement

On Tuesday, the market focus was on the EUR/USD, which traded lower due to concerns about slower economic growth, leading to increased demand for safe-haven assets. The divergence between the rate paths of the Federal Reserve (Fed) and the European Central Bank (ECB), along with contrasting data from the United States and the euro zone, contributed to the pair’s decline. The euro zone’s composite PMI for May decreased to 53.3, with a deeper contraction in the manufacturing component at 44.6.

In contrast, the U.S. Philly Fed services index improved to -16.0, showing growth in the new orders component. This mixed data caused investors to adjust their expectations for the Fed and ECB rate paths, with rate cuts now priced in for both central banks in the Eurodollar and Euribor rates markets.

Consequently, the USD Index rose slightly by 0.27%, and the dollar’s yield advantage increased, reflected in the widening U.S.-German 2-year spreads. In other major pairs, GBP/USD was slightly lower by 0.17%, AUD/USD fell by 0.57%, and today we are expecting the RBNZ rate statement. The market remains attentive to the developments in central bank policies and economic data, as they continue to impact currency pairs. Traders will closely watch the upcoming RBNZ rate statement for any indications of potential changes in interest rates or monetary policy.

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| NZD | Official Cash Rate | 10:00 | 5.50% |

| NZD | RBNZ Monetary Policy Statement | 10:00 | |

| NZD | RBNZ Rate Statement | 10:00 | |

| NZD | RBNZ Press Conference | 11:00 | |

| GBP | Consumer Price Index (y/y) | 14:00 | 8.2% |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.